Judi Hunter – Ward 5 Trustee

EDUCATION FUNDING

An educated society is one of the cornerstones of a democratic society. There is a cost. For the 2025.2026 school year, almost 11 billion dollars in education funding and another 47 billion over 3 years for school builds and improvements through the School Accelerator Program.

The provincial government implemented a 4.5 percent hike in the Education Property Tax (EPT), which was frozen in the 2024- 25 budget year. Municipalities collect the EPT for the provincial government. The EPT is levied alongside municipal property taxes, based on the value of the property. “Even with all those dollars collected province-wide and including this 4.5% increase, the Education Property taxes will only cover 31.6 percent of the K to 12 education budget,” Superintendent Luterbach stated in an interview with Rocky View Weekly. General revenues of taxes collected across the province will pay the remaining shortfall. The success of the educational system is important to all taxpayers as our students are our next generation of innovators, leaders and citizens.

Just as our society evolves and changes so does our educational system. Our schools are responding to many changes. Since COVID there has been a significant increase in the number of students dealing with emotional issues. As a normal part of the curriculum, students are learning strategies to deal with anxiety and social pressures. The Alberta curriculum has been revised to include financial literacy as a component from K-12. The curriculum also now includes a career development component from K-12. The focus is to provide students an opportunity to explore different careers as they progress through the grades with high school students can explore the trades, participate in post- secondary opportunities and take on the job training.

School systems deal with the many medical needs of students; this includes facility adaptations, specialized equipment, tools and staff.

Literacy and numeracy are more important than ever in our digital world, thus the focus on ensuring students receive early intervention.

CARBON TAX

ASBA (Alberta School Board Association) has been advocating both provincially and nationally on the position statement related to carbon tax: That school boards be fully rebated the cost of the carbon tax or levy (SGM 2016). Following his swearing-in as Prime Minister, Mike Carney removed the consumer carbon tax effective April 1 through an Order in Council (OIC). Further details will be available in the federal OIC database soon. School Boards are advocating for this tax to be removed on school boards as well.

EDWIN PARR NOMINEE

Cochrane High School teacher Connor Benson is this year’s Rocky View Schools (RVS) Edwin Parr Award Nominee. The Edwin Parr Award annually recognizes excellent first-year teachers across Alberta. Every year, teachers from ASBA member school boards across the province are nominated to receive the award. RVS is part of ASBA Zone 5. The Zone 5 celebration takes place on May 30, 2025.

CONSTRUCTION FUNDING

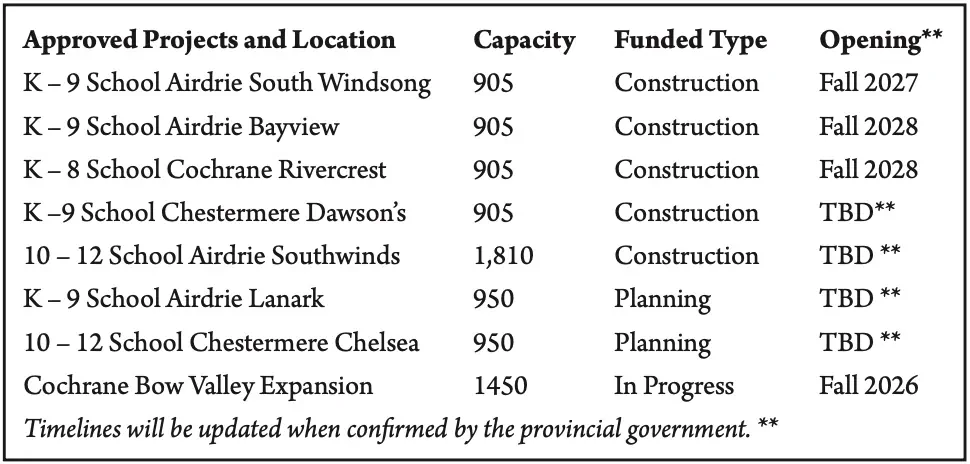

Rocky View Schools has been the recipient of new school announcements from the School Accelerator Program through its advocacy initiatives and support from parents and communities. There are a total of 8 projects approved for Rocky View to address our need for classroom space for students. (see table below)